Blog

Click here to go back

Quicker and Easier Workers’ Comp Reporting

This is the third in a series of blog posts that will specifically examine QuickBooks from an agriculture perspective. There is no “QuickBooks for Ag”. So how can we use some of the features in QuickBooks if we are in the ag business?

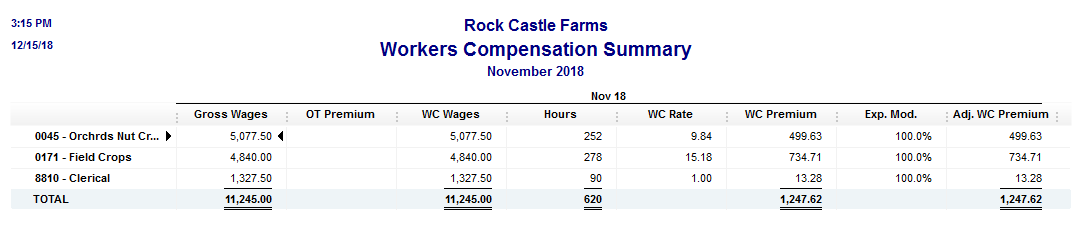

QuickBooks has a feature that will allow the cost of workers’ compensation to be tracked in the system. This will accrue the expense so it appears in the correct period on financial reports. It also results in the ability to run reports that will show wages subject to workers’ compensation, the rates and classifications, and the amount of premium due for a specific time period.

Tracking this expense as it accrues rather than when it is paid also allows it to be associated with various jobs and/or classes.

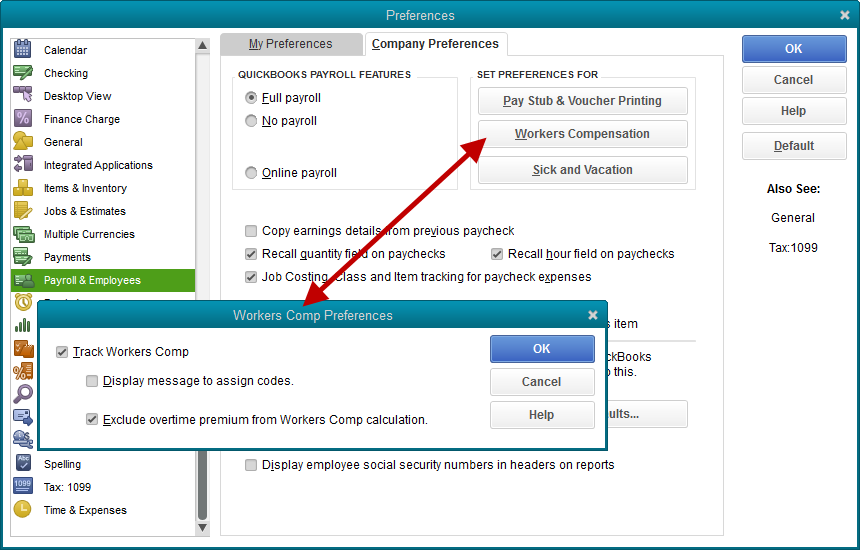

The first step to tracking workers’ compensation costs is to set the preference.

Once the preference is set, a wizard is available under the Employees dropdown menu to help you complete the setup. Employees->Workers’ Compensation->Manually Track Existing Workers’ Comp Policy.

The wizard will take you through a number of steps setting up the workers’ comp accrual. You will need information like:

• The name of your workers’ comp insurance carrier.

• Job classifications and rates.

• Experience modification factor.

• Policy Number (optional, but good to have).

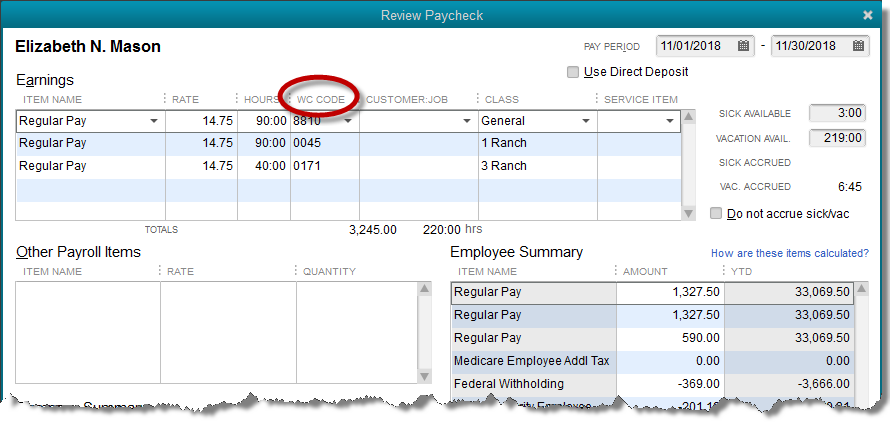

You may assign each employee the appropriate workers’ comp code. Often, in agriculture, a worker may be subject to various workers’ comp codes depending on various required functions on the farm or ranch. It’s possible to leave employees unassigned. Alternatively, if an employee can be classified under more than one code, but commonly fall under one specific designation, Make that most-common selection in this window.

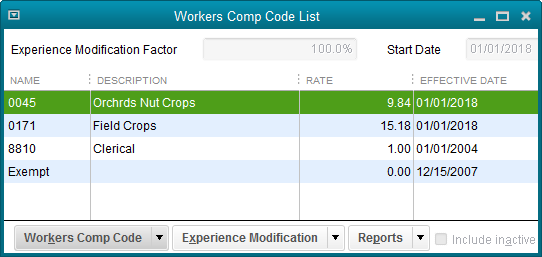

You will need to enter your Experience Modification as this affects your premium.

Enter the rates for each workers’ comp code.

If you pay overtime wages, a screen will allow you to specify whether or not the overtime premium is included for insurance premium calculations.

Let’s say a worker earned $10 per hour for regular time and $15 per overtime hour. Excluding the overtime premium would cause QuickBooks to calculate the premium for every hour as though it were paid at $10. The additional $5 paid for overtime hours would be ignored.

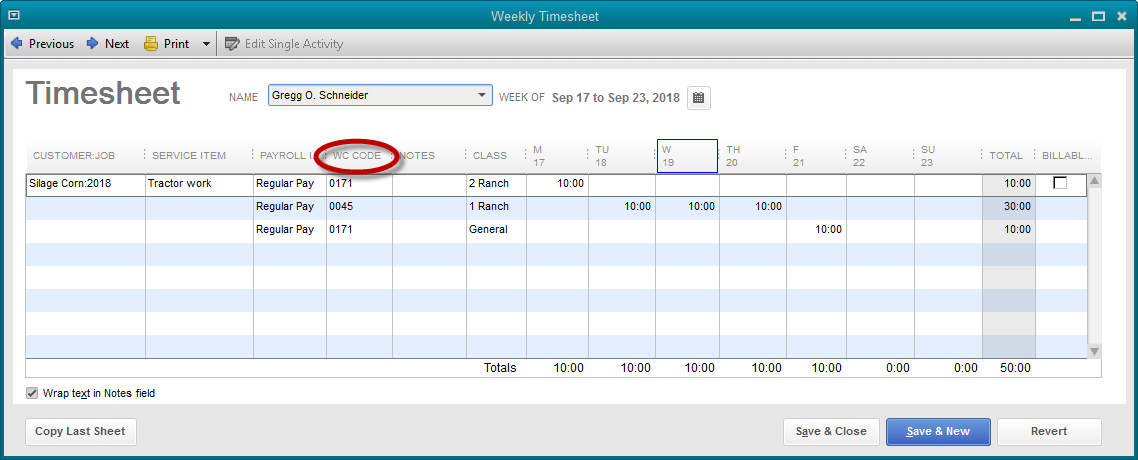

Using multiple workers’ compensation categories for employees means that their hours worked must be broken down into those categories. That can be acconplised in two ways.

When creating payroll checks, the paycheck detail screen will need to be opened for each employee. Here, the workers’ compensation information can be entered.

Some QuickBooks users will prefer entering time on the weekly timesheet from which it will automatically flow to payroll. There is a column for workers’ comp rates here as well.

The result of all this tracking work in QuickBooks is a report detailing the wages paid, under which categories, and the premium that will be owed.

A little more work up front saves a lot of time at the end.

Call us if you would like to try this feature but need help with the implementation. You may view this feature setup as a video here.