Blog

Click here to go back

Which Crops/Fields/Locations Made Money?

Using QuickBooks Class for locations, fields, and crops

This is the fourth in a series of blog posts that will specifically examine QuickBooks from an agriculture perspective. There is no “QuickBooks for Ag”. So how can we use some of the features in QuickBooks if we are in the ag business?

QuickBooks has a feature called Class. It provides another “bucket” besides accounts in which to collect transactions.

This is often used in an organization where the same or similar income and expenses need to be tracked for different departments, locations, funds, etc.

For instance, a non=profit organization might track donations as income, but also want to know if those donations are for general use, building fund, or other special purposes, class might be your solution.

A business might have more than one department for which income and expenses are tracked. Or, it could have more than one location and want to track the financial performance of each location.

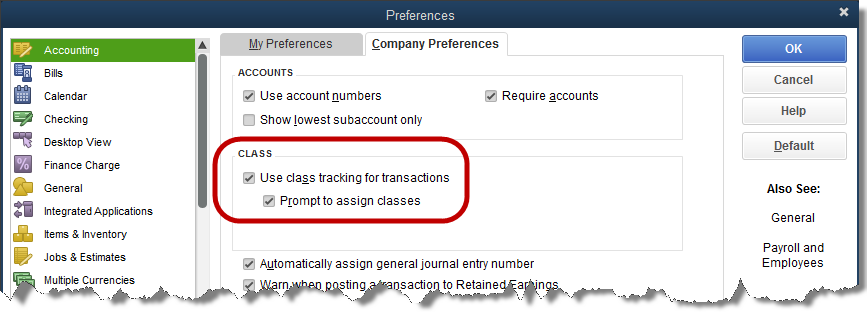

Turn on the class feature in preferences.

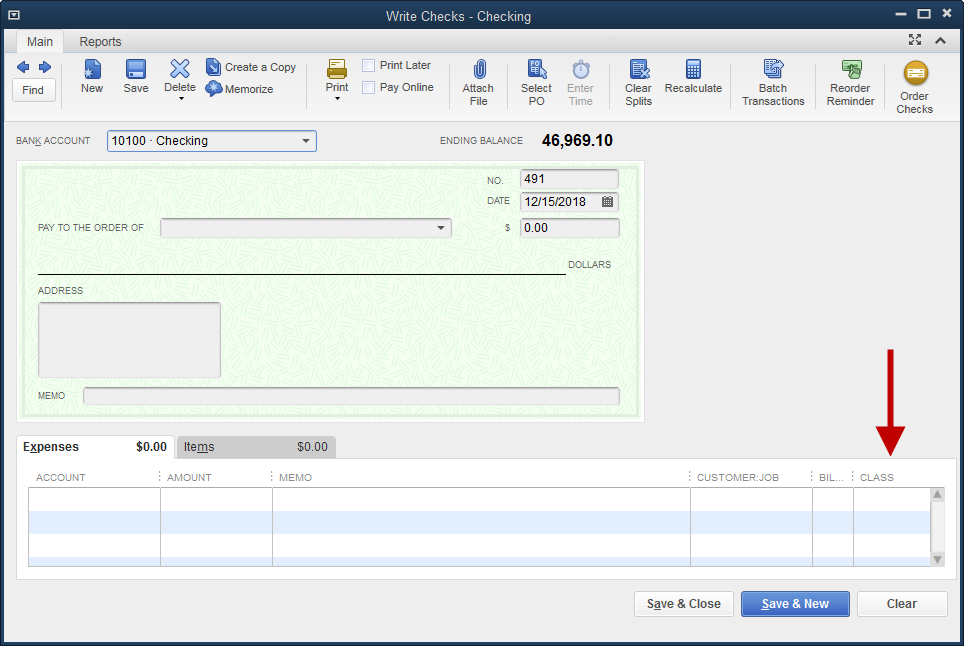

Once the option is turned on, transaction forms contain an added column for this information.

Classes can be added ‘on-the-fly’ by typing in the name in the class column and selecting Add when QuickBooks does not recognize the name. Or, you can navigate to Lists->Class List and enter your desired classes there.

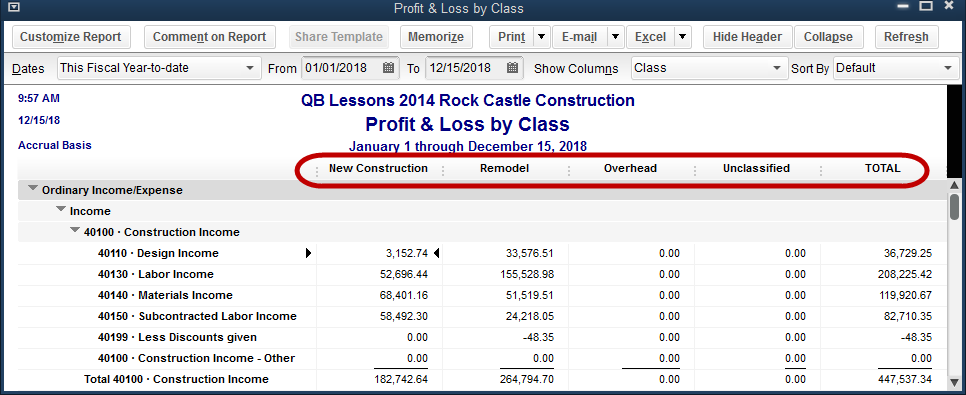

Using class designations on your transactions results in a profit and loss report that can be analyzed based on whatever criteria you are tracking with the class feature.

Keep the following in mind:

* Use only one criteria. Using both location and department for classes will create a confusing report.

* Create a general or administrative class for transactions that do not fit into any of the special class categories. That way, when unclassified transactions show up on the Profit and Loss by Class, you know they need to be corrected.

* Class is for income and expense, not for assets and liabilities. While QuickBooks offers a balance sheet by class, it is cumbersome and difficult to use and requires stringent guidelines on entering transactions.

What about Agriculture?

This feature can be used in a couple of ways for ag QuickBooks users.

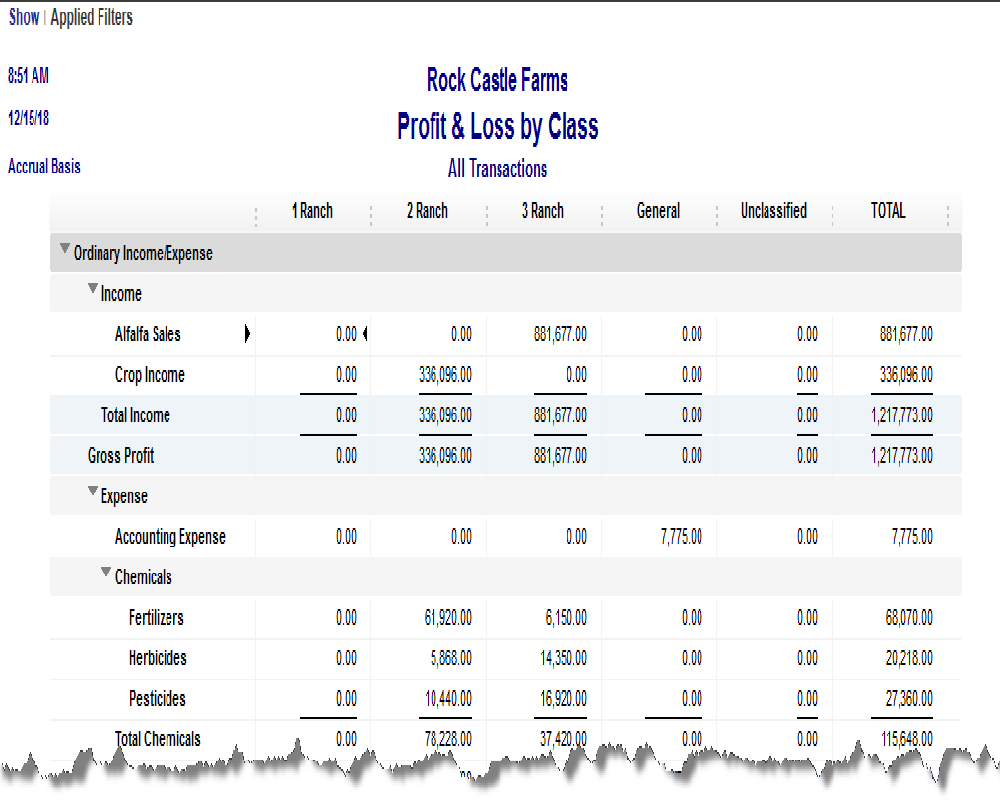

If there is more than one location, locations for which income and expense amounts can be determined, this would be a good use for class.

Here is an example of a profit and loss report for an agriculture-based sample company using this method.

Another use for the Class feature is for field, crop, and/or year. For instance classes might be created for “Field 3 Corn 2018”. And then a new class “Field 3 Corn 2019” would be created the next year.

The reason for making the class names so specific is to prevent crop income or expense showing on a report and being allocated to the wrong crop year. An expense might be billed late by a supplier, or income is received late, after the new year has already been started.

There’s always that possibility, that if there is only one class for Field 3, some transaction for the year 2018 gets recorded in 2019, thus compromising the accuracy of the report for both years.

Using class in this way will work fine for some. It could create a very long class list over time. There’s another solution that you should consider.

More on that in the next post.

You can watch a video demonstration using Quickbooks Class here.